Parametry

- 246 stránek

- 9 hodin čtení

Více o knize

Celebrating the centennial of Benjamin Graham, the father of value investing, this book introduces his investment theories alongside his life and work. Janet Lowe offers insights into how Graham became a pivotal figure in investing. His seminal works, *Securities Analysis* (1934) and *The Intelligent Investor* (1949), remain enduring classics, influencing notable investors like Warren Buffett, William Ruane, and Walter Schloss. Graham's teachings serve as essential guidelines for navigating the investment landscape. Key commandments include: 1. Be an investor, not a speculator. 2. Differentiate between price and value. 3. Seek bargains in the market. 4. Embrace the Graham formula. 5. Approach corporate figures with skepticism. 6. Accept that not every decision will be flawless. 7. Higher math isn't necessary for smart investing. 8. Diversify with stocks and bonds. 9. Include a variety of stocks in your portfolio. 10. Prioritize quality when uncertain. 11. Look to dividends for insights. 12. Protect your shareholder rights. 13. Exercise patience. 14. Think independently. These principles encapsulate Graham's investment philosophy, guiding individual investors, money managers, brokers, and stock market enthusiasts to invest as if Graham were still sharing his wisdom today.

Nákup knihy

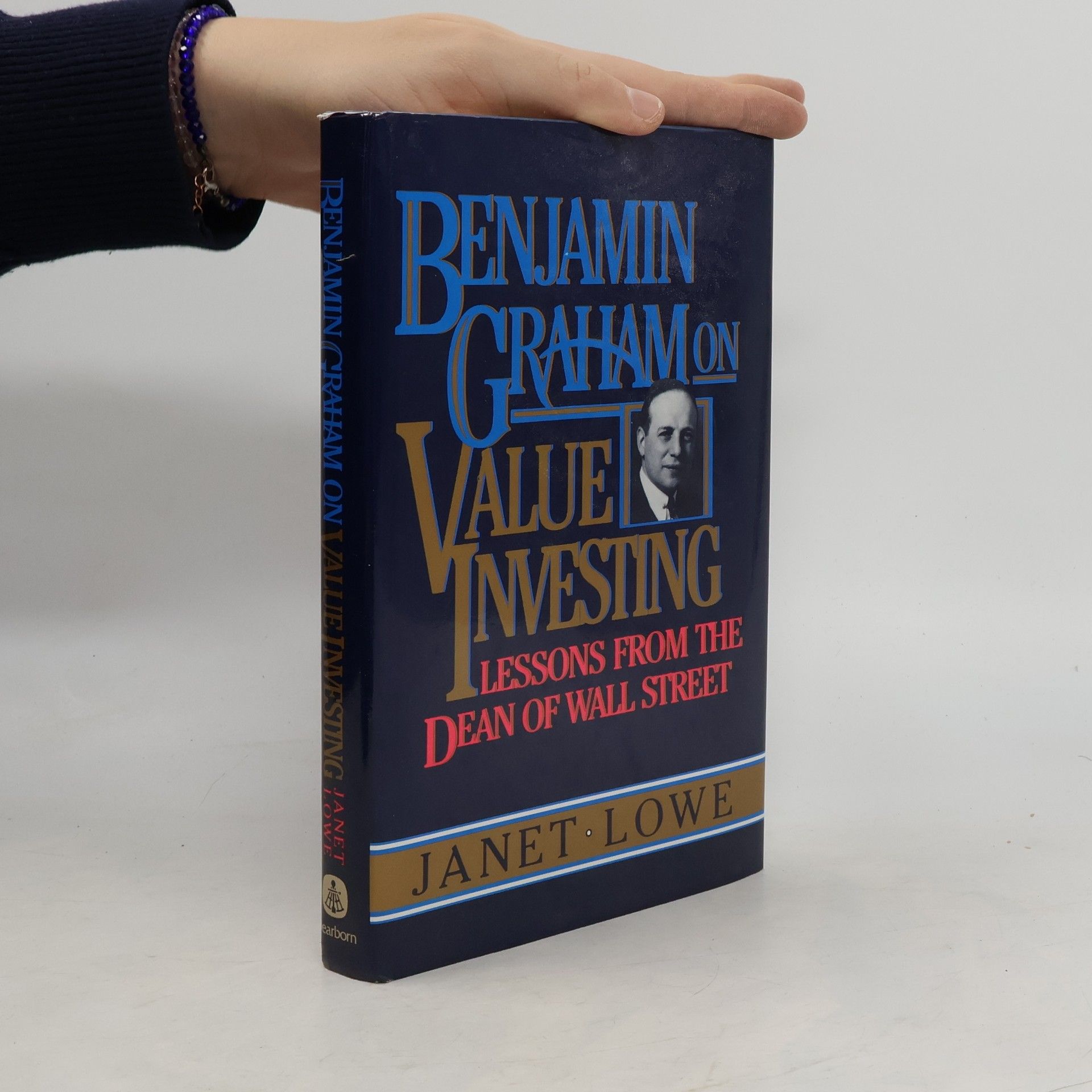

Benjamin Graham on Value Investing, Janet Lowe

- Jazyk

- Rok vydání

- 1994

- product-detail.submit-box.info.binding

- (pevná)

Doručení

Platební metody

Tady nám chybí tvá recenze.